PayZen is trusted by hospitals, health systems, and physician groups of all sizes

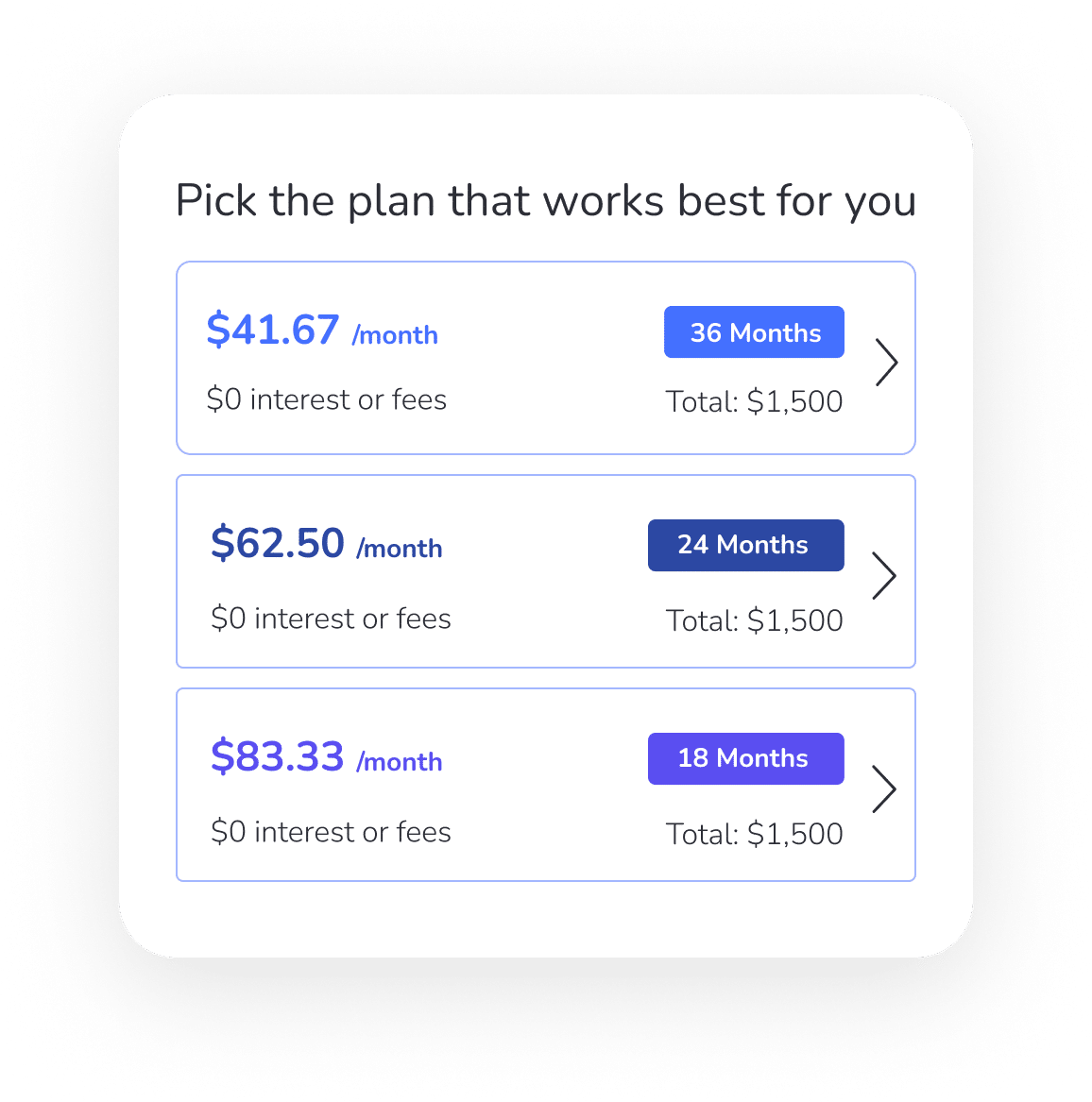

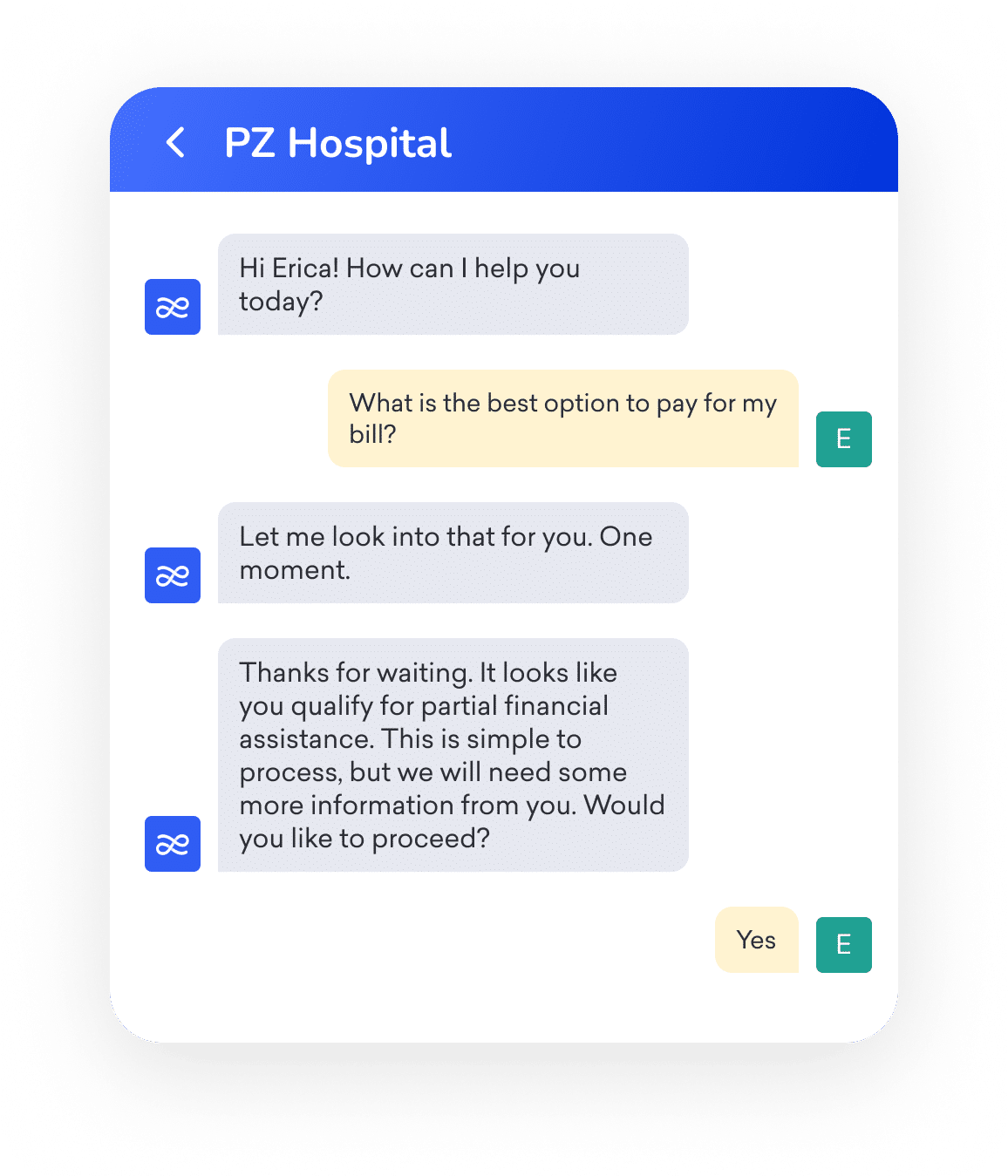

Solving affordability at every stage of the care cycle

The impact of our patient financing solutions

Providers see accelerated capital and a substantial lift in patient payments

Our healthcare providers have improved patient payment rates by 32%

Patients are highly satisfied and getting the healthcare they need

Our patient NPS score of 71 is 25+ points above the industry average

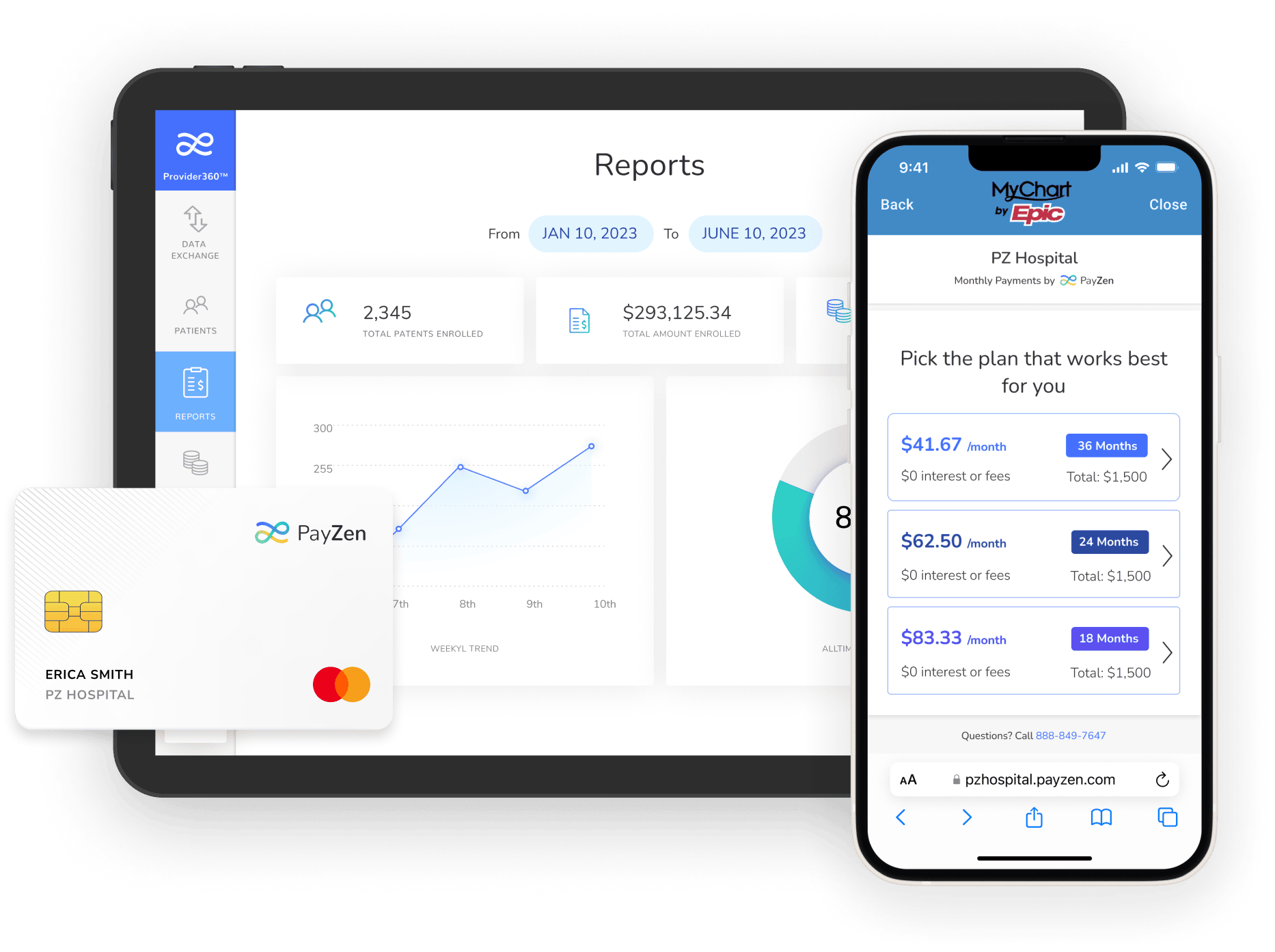

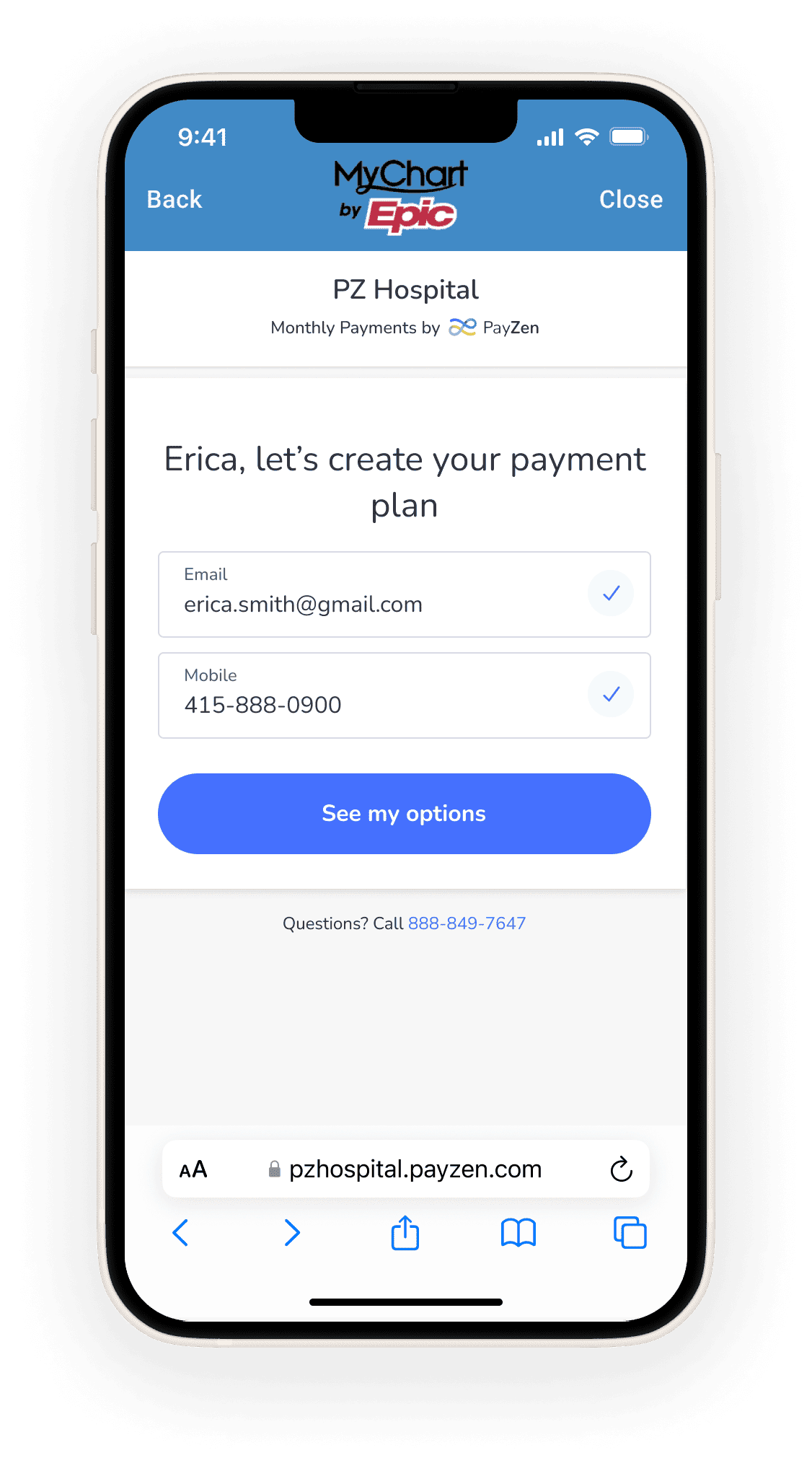

Integrate PayZen with your existing healthcare ecosystem

Why we need patient financing solutions

The vicious cycle of patient affordability

Check out these resources for healthcare and patient finance leaders

Maximize Revenue with Patient-Centric Strategies

As patient responsibility surges to make up over 30% of Net Patient Revenue, healthcare leaders have an opportunity to meaningfully impact financial performance simply by fine-tuning patient financing strategies. Embark on a journey through our four-step guide, providing actionable insights to bo...

Propensity to pay vs. ability to pay: what’s the difference?

And how does ability to pay affect patient payment success? The billing and collections industry often uses the concept of propensity to pay to express the likelihood that a group of customers will pay their bills. Propensity-to-pay calculations continue to get more precise, with artificial...

How health systems can strengthen finances amid recessionary pressures

Now is the time for hospitals to shore up cash flow Among the uncertainties facing the healthcare industry in 2023, one challenge is already rising to the top of the priority list: cash flow. Half of U.S. hospitals ended last year with a negative operating margin, with rural hospitals expe...