About 100 million Americans have healthcare debt¹.

In the infographic below, discover seven things you should know about how medical debt impacts patients and providers. Then, learn what healthcare providers can do about medical debt in this blog post.

Seven Alarming Statistics on Medical Debt – and What Healthcare Providers Can Do About It

Research shows that medical debt keeps many patients from getting the care they need–and affordability is a key driver in access to care.

Patient Total U.S. medical debt: $195 billion.¹

For some, that could mean bankruptcy or other financial hardship.

Patient 40% of Americans would have problems paying a $400 bill.²

Patients may delay or skip needed care because they cannot pay.

1 in 7 have been denied care because of medical debt.³

Unpaid debt can prevent patients from receiving necessary care when it is needed most.

Black and Hispanic adults are more likely to have medical debt.⁴

Financial barriers are a Social Determinant of Health (SDoH) that can increase health inequity.

People ages 35 and older are more likely to have medical debt.⁵

They’re too young for Medicare but old enough to need regular medical care.

The average family pays over $22,000 a year for health insurance.⁶

Increased premiums, higher deductibles, and larger copays transfer more financial responsibility to the patient.

Nearly 1 in 5 households has skipped necessary healthcare.⁷

Families earning less than $24,000 annually were most likely to skip needed care.

About 3 million Americans owe $10,000 or more in medical debt. Another 13 million people owe between $1,000 and $10,000.

Not All Medical Debt Is the Same

16% of respondents told the U.S. Federal Reserve² that they’d put medical bills on a credit card and pay it off over time.

3% said they’d fund the debt with a bank loan or line of credit.

2% said they’d use a payday loan, deposit advance, or overdraft.

Paying for medical care with high-interest credit cards and other options can compound patient debt over time – and put affordable healthcare even further out of reach.

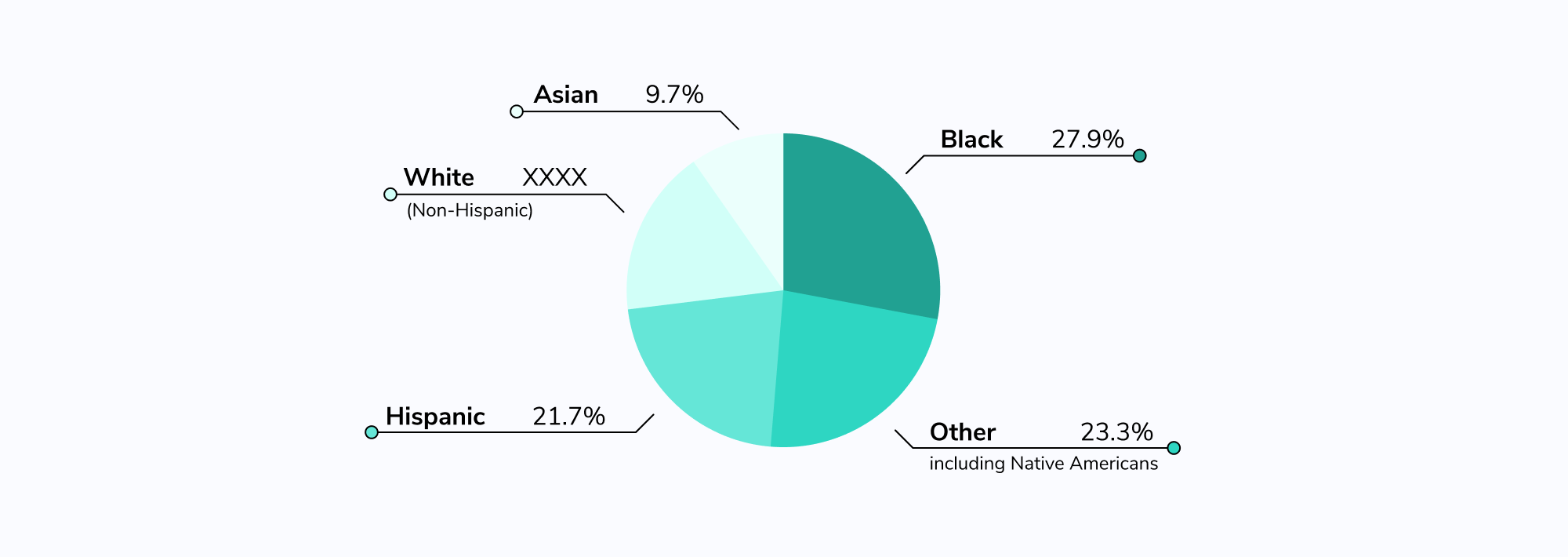

Medical Debt Hits Some Communities More

Medical debt affects some communities more than others–disproportionately impacting Black and Hispanic households, according to the Consumer Financial Protection Bureau. Here’s the percentage of each group that has medical debt:

How Providers Can Help Patients and Themselves

Healthcare providers can help patients afford the care they need and improve their cash flow at the same time by partnering with financial technology companies, such as PayZen, to offer patient-friendly payment options that:

- Give patients flexibility based on their unique financial situation

- Accelerate the provider’s cashflow

- Improve healthcare access and the patient experience

Affordable payment plans work best when they:

- Are interest-free

- Have no additional fees beyond the actual cost of care

- Are available to all and don’t require a credit check for approval

PayZen’s AI-powered healthcare affordability platform can help patients pay for the care they need, while accelerating cash flow for providers.

¹ KFF. “The Burden of Medical Debt in the United States”

² U.S. Federal Reserve. “Report on the Economic Well-Being of U.S. Households in 2018 – May 2019”

³ Petersen-KFF Health System Tracker. Petersen. “How does cost affect access to care?”

⁴ Consumer Financial Protection Bureau. “Medical Debt Burden in the United States”

⁵ KFF. “1 in 10 Adults Owe Medical Debt, With Millions Owing More Than $10,000”

⁶ KFF. “2021 Employer Health Benefits Survey”

⁷ Gallup. “In U.S., An Estimated 46 Million Cannot Afford Needed Care”