TL;DR

Ignoring healthcare patient financing can lead to more bad debt, staff burden, deferred care, and loss of revenue. Without flexible, AI-powered solutions, providers risk reduced loyalty and competitive disadvantage. Smart healthcare patient financing offers affordable plans that improve patient satisfaction and safeguard your financial health.

Healthcare providers aim to deliver exceptional care, but rising economic pressures make that goal increasingly challenging. Patient balances over $7,500 tripled between 2018 and 2022 leaving many healthcare providers chasing down payments from patients. As a result, hospitals lose millions annually in unpaid bills and write-offs, while uninsured and underinsured patients face growing barriers to care.

This article highlights the hidden costs of neglecting patient financing solutions and explores how providers can mitigate these challenges to improve financial stability and foster long-term trust and loyalty with patients.

1. Higher Rates of Bad Debt and Write-Offs

Healthcare providers see firsthand the weight of financial stress on their patients. Many Americans want to pay their bills, but it’s often out of reach with rising expenses and limited resources. The numbers are sobering: the average patient can afford just $97 per month for medical expenses, leaving many unable to manage larger bills.

Without flexible, tailored payment options, unpaid balances often become bad debt, directly impacting the healthcare provider’s bottom line.

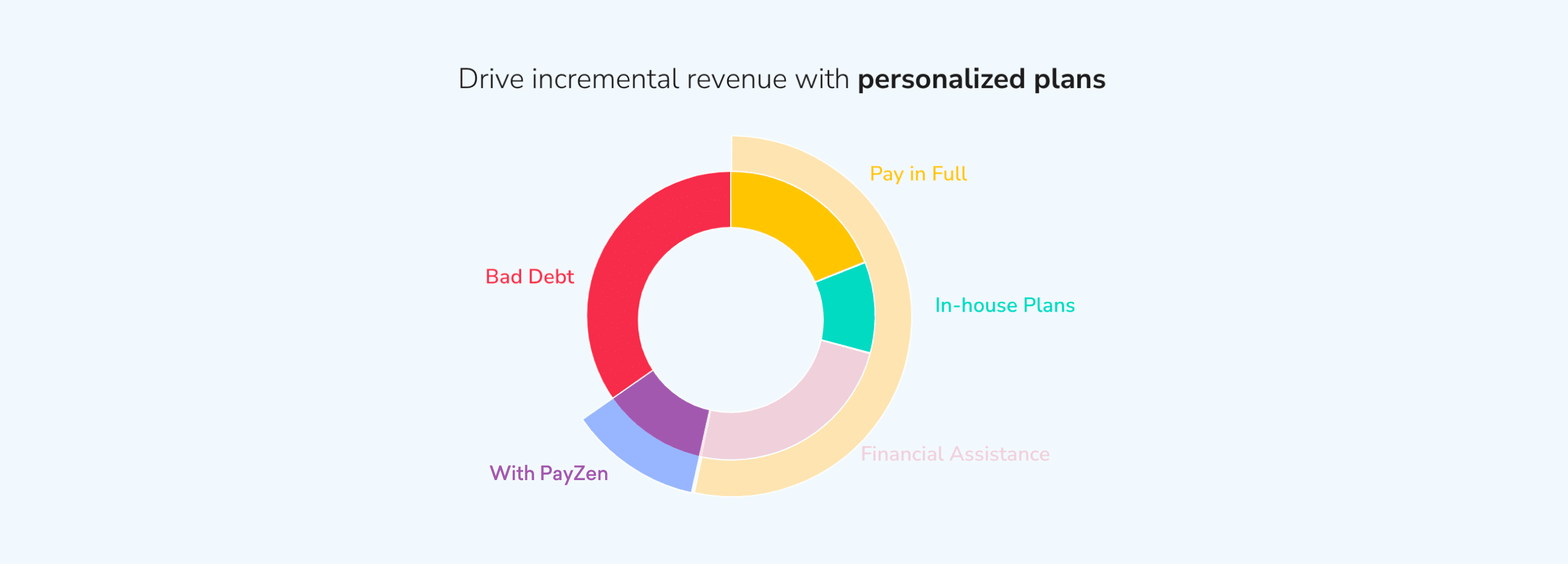

But there’s hope. Patients overwhelmingly say that flexible, long-term payment options would help them meet their financial obligations. However, traditional in-house payment plans often lack the flexibility and personalization patients need to be actually affordable. At the same time, staffing constraints make it difficult and costly to effectively manage overdue accounts.

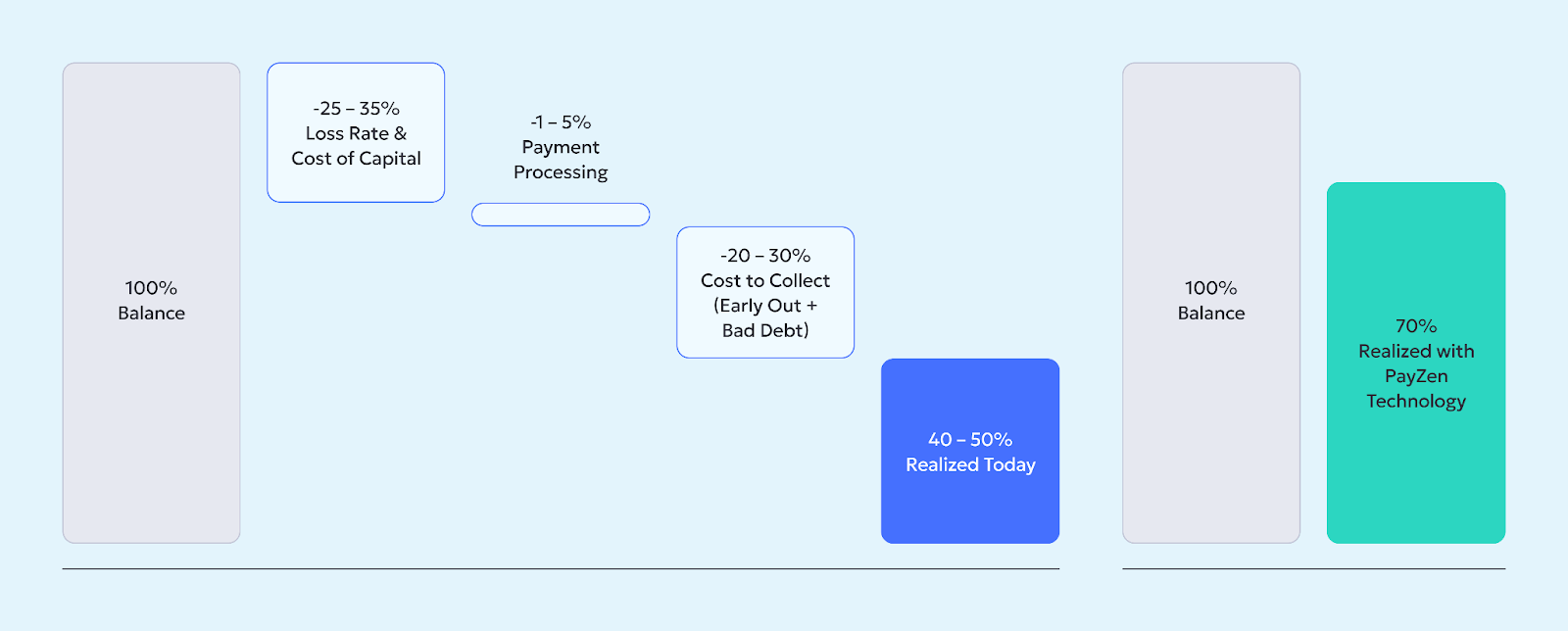

Zero-interest patient financing solutions, especially those powered by technology, data, and AI, can personalize payment plans and proactively support patients to reduce financial stress. Providers using PayZen report a 32% increase in collections and a 30% reduction in bad debt. Unlike traditional collection agencies, patient financing solutions aim to improve the overall patient experience. PayZen, for instance, has a Patient NPS score of 71, compared to the industry average of 41.

“We’ve seen patient liability collections go up and bad debt trending downwards…and our patients are relieved to have payment plans they can actually manage.” – Emily Goertz, UTMB Health.

2. Increased Administrative Costs for Collections

The administrative burden of managing patient billing and collections is significant and rising. Without a financing partner, administrative resources related to billing and collections can balloon, diverting attention from core responsibilities or strategic investments.

Automation and data-driven workflows can alleviate this burden by simplifying payment management. PayZen’s healthcare patient financing solutions can help your organization improve collections and reduce bad debt. Healthcare organizations using PayZen have reported cost savings of on average 10% in collections-related expenses, allowing staff to focus on more strategic and patient-centric initiatives.

“With PayZen, our staff isn’t chasing payments anymore. They’re focused on the work that will shape our future.” – Rodney Clark, COO of North Sunflower Medical Center.

3. Opportunity Cost of Constrained Capital

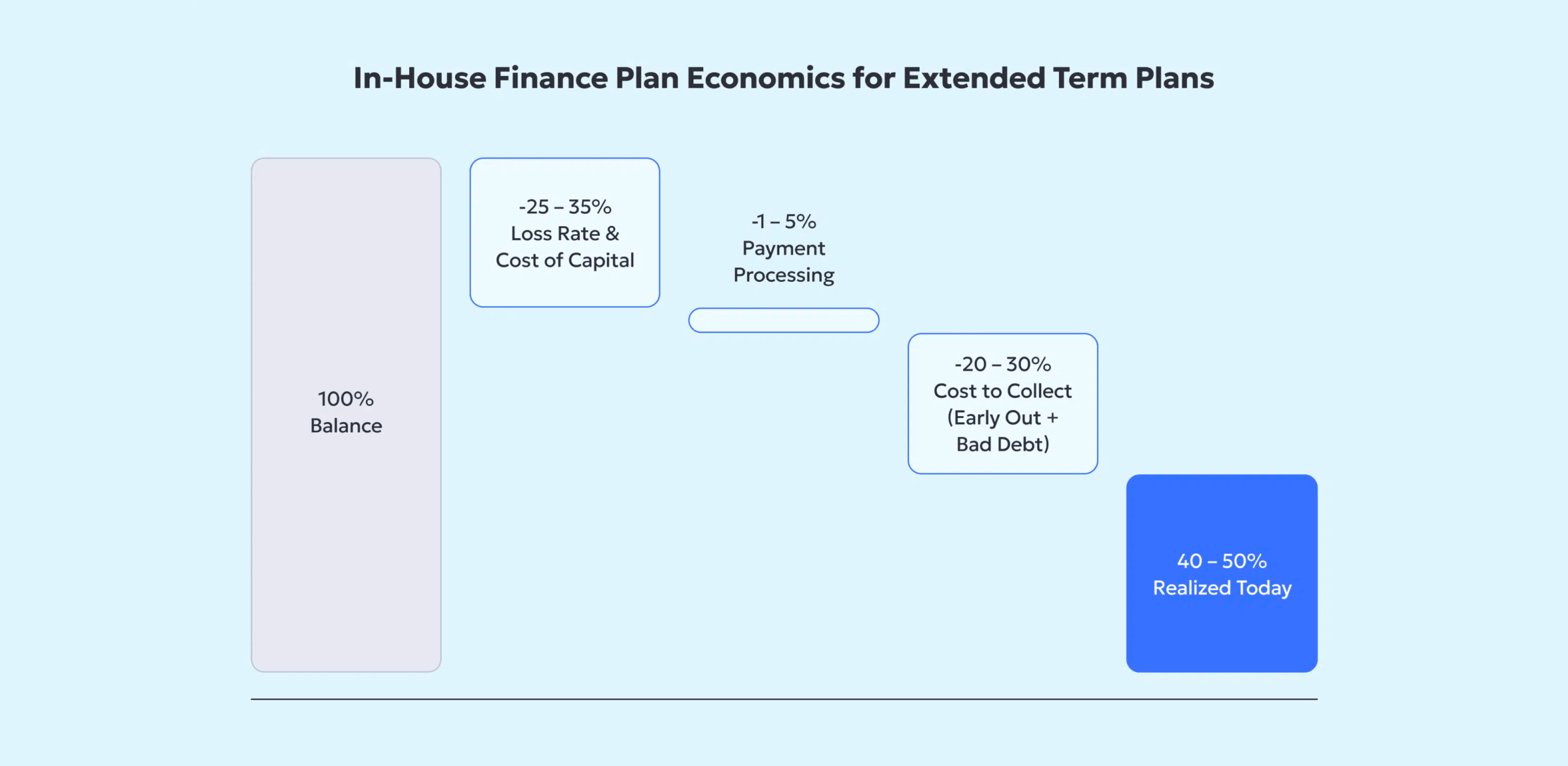

In-house payment plans tie up significant capital particularly on the longer-duration plans patients need to pay down large bills. This float impedes providers from pursuing other high-impact initiatives like expanding services or staffing, investing in new technology, or upgrading facilities.

Outsourced patient financing services free up these resources by removing unpaid balances from the provider’s books, enabling faster reinvestment in areas that enhance patient care and operational efficiency.

4. Decreased Patient Satisfaction and Loyalty

Financial stress affects patients’ overall satisfaction with their healthcare experience. A recent study found that 66% of Americans live paycheck-to-paycheck, and are overwhelmed when faced with large medical bills. Limited payment options contribute to even more dissatisfaction and discourage follow-up care.

PayZen improves the patient experience by providing flexible, zero-interest payment plans that ease financial stress. Providers who partner with PayZen report a 50% increase in patient satisfaction, resulting in long-term loyalty.

“Patients really benefit from the flexibility, and their feedback has been tremendous so far.” – Tracie Young, Regional Revenue Cycle Director.

5. Lost Revenue from Patients Deferring or Avoiding Care

When people worry about healthcare costs, many delay or forgo treatment altogether. This year, 36% of Americans said they delayed medical treatment due to cost concerns. These decisions often lead to worsening health conditions, which ultimately require more expensive interventions down the line. 49% of patients who postponed healthcare said the health problem they were waiting on treating worsened. For providers, this exacerbates revenue challenges and leads to poorer community outcomes.

Flexible patient financing options, such as a move to a pre-service card, empower patients to proceed with necessary care without financial strain and support organization efforts to increase pre-service collections. By removing cost barriers, providers can improve patient outcomes while stabilizing revenue streams and reducing long-term care expenses.

6. Competitive Disadvantage and Brand Impact

In today’s competitive healthcare landscape, affordability and convenience are key factors in patients’ healthcare decisions. Organizations that lack flexible payment solutions risk losing patients to competitors who provide better financial options.

Patient financing not only supports affordability but also enhances a provider’s reputation. A modern, user-friendly experience for patient payments demonstrates a commitment to affordability and innovation, ensuring relevance in a competitive market.

Meeting Challenges with Compassion and Innovation

The financial realities facing healthcare providers are complex and challenging. Rising costs and patient debt, administrative burdens, and regulatory changes all add difficulty to the mission of delivering quality care. While patient financing seems like only one small piece, the hidden costs of ignoring it add up.

Partnering with innovative patient financing companies like PayZen empowers healthcare organizations to reduce bad debt, alleviate operational strain and improve patient outcomes and satisfaction. Tailored, AI-driven payment plans provide sustainable solutions for both providers and patients, creating a pathway to a more financially secure healthcare system.

Ignoring patient financing can lead to higher bad debt, reduced collections, administrative burden, deferred care for patients, and a weaker competitive position.

Patients may struggle to afford care, leading to frustration, deferred treatments, and negative perceptions of the provider.

Yes. AI-powered patient financing solutions increase collections, reduce unpaid balances, and provide faster access to revenue.

Choosing the right partner ensures patient affordability, minimizes administrative burden, increases collections, and maintains a positive patient experience.