Patient Financing: Still Relying on Legacy Approaches?

Welcome to the new way

Patient-centric. AI-powered. Fully automated. With technology at the core.

PayZen - A smarter, AI-driven approach to Patient Financing

When it comes to patient financing solutions, not all platforms are created equal. While other solutions offer patient financing options, PayZen provides a smarter, AI-driven approach to patient financing that ensures patient affordability while maximizing financial outcomes for healthcare providers.

Patient Financing Done Right

PayZen vs legacy patient financing companies

Average 30% collection lift over baseline

High-quality patient experience

Maintain happy patients with an exceptional, embedded digital enrollment and customer service experience you won’t find in other patient financing companies.

Underwhelming uplift to overall collections

Clunky and disjointed for patients

Financial program awareness relies on call centers, enrollment process is cumbersome, and customer service is limited.

Average 30% collection lift over baseline

True AI-powered platform

Unlock higher healthcare revenue and cash flow with tailored patient financing options and automated payment plans.

Underwhelming uplift to overall collections

Not real-time or data-driven

Other patient financing companies have pre-defined offers that lead to low signups and marginal impact to patient collection rates.

Average 30% collection lift over baseline

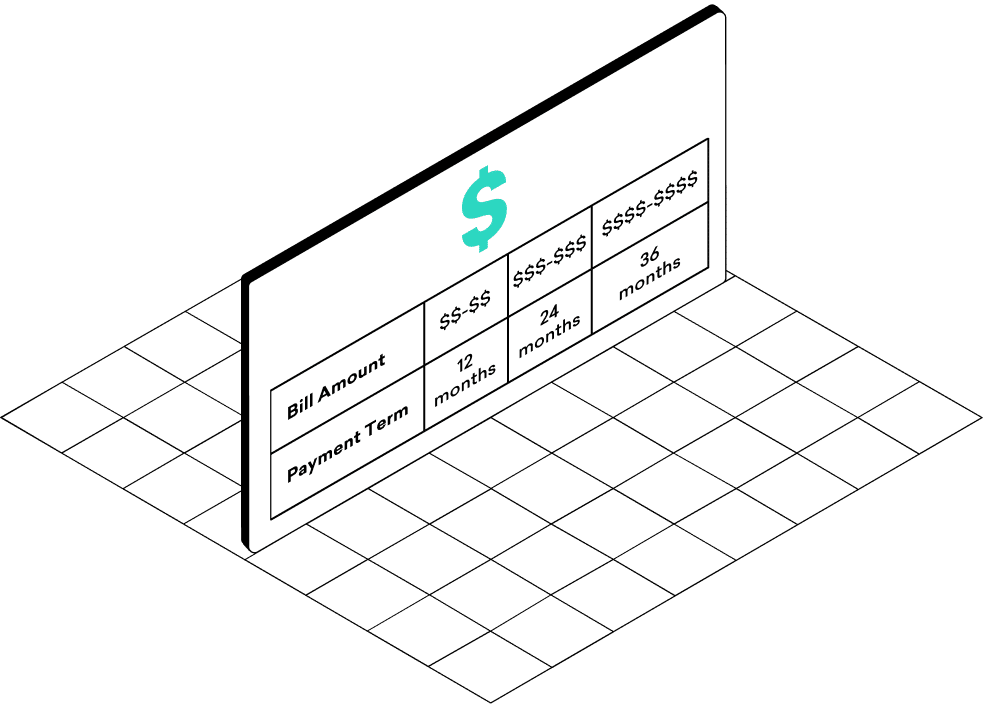

End-to-end automation

Make your revenue teams more efficient with effortless integration and a fully automated patient financing solution.

Underwhelming uplift to overall collections

Burdensome staff experience

Patient enrollment requires provider staff to make a phone transfer and the reconciliation process is manual.

Why Hospitals and Health Systems Choose PayZen

Happier Patients. More Revenue. Really.

PayZen's AI-powered, seamlessly embedded platform unlocks 30% more patient payments for providers, and our patient satisfaction is over 50% higher than industry average. When you partner with a patient financing company trusted by top providers in healthcare, you really do get the best of both worlds.

Superior Patient Experience

- Simple, user-friendly digital experience

- High-quality, empathetic patient support with both a self-service portal and a US-based customer service team

More Significant Patient Payments Lift

- Automated patient engagement and tailored financing options lead to higher adoption

- Proactive, patient-friendly servicing approach keeps patients on track

Lower Administrative Burden

- Ready-built software integrations that set PayZen apart from legacy patient financing companies.

- Fully turnkey patient financing program from engagement to plan enrollment to servicing

Recourse vs. Non-Recourse Financing: Why It Matters

Most patient financing companies use recourse patient financing, meaning hospitals assume financial risk if patients default on payments. In addition to the benefits of PayZen’s automation, AI, and data-driven approach, PayZen offers a non-recourse patient financing solution, ensuring health systems providers receive upfront payments with zero liability.

With PayZen’s AI-driven patient financing options, hospitals can focus on delivering high-quality patient care without the added strain of managing unpaid balances. For hospitals and health systems seeking patient financing that eliminates financial risk, PayZen’s technology ensures affordability while immediately reducing A/R.

Make the Switch to Smarter Patient Financing

Hospitals and providers nationwide trust PayZen to enhance financial health while ensuring patients receive the care they need. Don’t settle for outdated financing approaches—experience the PayZen difference today.

More Payments Collected

Less Administrative Work

Happier, Healthier Patients