The Latest at PayZen

Propensity to pay vs. ability to pay in healthcare: What’s the difference and how to achieve success?

The billing and collections industry often uses the concept of propensity to pay to express the likelihood that a group of customers will pay their bills. Propensity-to-pay calculations continue to get more precise, with artificial intelligence-based algorithms to interpret historical data and forecast collection success rates. But especially when it comes to patient collections in healthcare, ability to pay is also crucially important, yet historically overlooked.

Introducing the PayZen Care Card: A Timely Game-Changer for Healthcare Affordability

The good news from PayZen keeps coming and I couldn't be more proud to announce this latest milestone on our journey to bring patient financial health to healthcare. Today, we are publicly unveiling the PayZen Care Card, a natural expansion of our patient financing platform designed t...

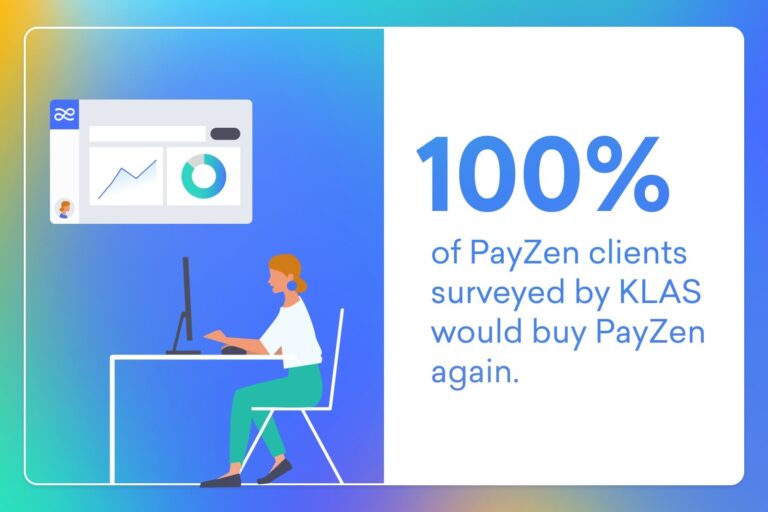

PayZen Recognized as Emerging Healthcare Affordability Solution

PayZen was founded in 2019 with a mission of solving the healthcare affordability problem for both patients and providers. We are proud to share that this month, KLAS Research (KLAS), the world’s leading third-party healthcare IT research organization, spotlighted PayZen’s platform as an emerging solution in the healthcare affordability space.

North Sunflower Medical Center Transforms its Patient Financial Experience

At North Sunflower Medical Center (NSMC), revenue cycle management is more than a business process. As the rural healthcare hub dedicated to improving the lives of the people in the Mississippi Delta, NSMC is woven into the fabric of its community. Any solution the hospital implements is used by its neighbors, church members—even friends and family. The hospital needed a process for collecting on self-pay patient balances that aligned with ...

How health systems can strengthen finances amid recessionary pressures

Among the uncertainties facing the healthcare industry in 2023, one challenge is already rising to the top of the priority list: cash flow. Half of U.S. hospitals ended last year with a negative operating margin, with rural hospitals expected to increase closures without the continuation of COVID relief aid. Given this pattern and the soaring costs of labor, supplies and services, it’s not enough to take a wait-and-see approach to your health system’s financial foundation.

How healthcare providers can tackle medical debt to help improve health equity

Millions of adults in the U.S. struggle to bear the weight of soaring health care costs. A June 2022 survey from Gallup showed that nearly 40% of Americans — an estimated 98 million people — had delayed or skipped healthcare treatments, cut back on regular household expenses, or borrowed money in the previous six months due to high costs of medical care.

Healthcare Fintech’s Key Trends in 2023: RCM teams will shift to meet patients where they are

The year ahead brings economic pressures for healthcare systems, but also fresh opportunities to improve healthcare revenue cycle management and RCM technologies that enhance the patient experience. Here at PayZen, we asked our team to predict the biggest industry trends that will affect providers and patients this year.

How Hospitals and Health Systems Can Help Patients Avoid Medical Debt

Medical debt is a serious problem for patients and healthcare providers. Fortunately, hospitals and health systems can take steps to protect their revenue and help patients afford care. For millions of Americans, medical debt leads to a financial crisis, putting them at risk of poverty or even bankruptcy. For millions more, debt is a source of stress and aggravation. And for hospitals and health systems, unpaid medical bills mean decreased revenue, increased expenses, and the specte...

Two Steps to Accelerating Cash Flow While Enhancing the Patient Experience

You’ve done your homework and determined that your healthcare organization needs cash flow acceleration. You see it as the best way to avoid operating margin challenges in shaky markets while ensuring you better serve your patients.

The First Steps to De-Risking Your Balance Sheet Through Cash Acceleration

The balance between tending to your cash flow needs and nurturing the patient is a delicate one, but one that can be managed with very intentional steps and the latest in healthcare financial technology. Healthcare providers have faced unique challenges over the past three years, with more than half of U.S. hospitals projected to have negative margins through 2022. There is no...

Infographic: Seven Alarming Statistics on Medical Debt

About 100 million Americans have healthcare debt¹. In the infographic below, discover seven things you should know about how medical debt impacts patients and providers. Then, learn what healthcare providers can do about medical debt in this blog post.

Why Now is the Time to Invest in a Healthcare Affordability Platform

Delivering personalized patient payment plans is a major step in tackling the healthcare affordability crisis.