TL;DR:

The right patient financing solutions should boost collections, protect cash flow, and make care more affordable without adding work for your staff. Look for a partner that offers flexible, patient-friendly payment plans, integrates with your systems, and automates servicing. The best options improve patient experience, reduce bad debt, and align with your organization’s mission.

Choosing the right patient financing partner is critical for healthcare providers striving to make care more affordable and accessible. Today, nearly half of American adults struggle to afford healthcare costs, with 61% of patients avoiding care altogether due to financial barriers, making financing solutions an increasingly important component of patient access.

While approval, fees, and interest rates are important metrics for evaluation, providers must dig deeper. How will the financing solution affect the overall patient experience? What impact will it have on cash flow and team workload? A holistic evaluation ensures that the chosen partner supports not only the organization’s financial goals but also its mission to provide excellent patient care.

Here are three critical areas to explore when assessing a patient financing partner:

- How will it impact my patient experience?

Is the patient financing process transparent, easy to access, and free of credit checks or hidden fees? Are payment plans flexible, with options for payment holidays or adjustments, or are unpaid accounts sent to collections? Does the solution provide a modern self-service experience? If patients have questions, can they talk to a compassionate person, based in the U.S? Do they use AI to tailor payment plans for individual patients? - How will it affect our patient cash flow?

Does the solution help increase the share of paying patients? Will patient financing boost the volume of services by making care more affordable? Does it enhance cash realization, or must patients complete their payment plans? - How will using a patient financing service impact my team’s workload?

Is the initial setup straightforward? Does it integrate seamlessly with existing EMH/EHR systems and workflows?

Let’s dive deeper into how a patient financing partner can influence patient experience, cash flow, and staff workload.

How Patient Financing Impacts the Patient Experience

A patient financing solution should elevate the patient experience while aligning with the healthcare provider’s values. Key areas to evaluate include:

Credit Checks

Financing solutions that require credit checks can create significant barriers for patients. These checks harm patients’ credit and undermine trust, deterring vulnerable populations from seeking care.

As states expand access to healthcare for low-income, uninsured, and immigrant populations, aggressive financial practices, like credit checks, can erode these efforts.

PayZen’s no credit check, fee-free enrollment process aligns with hospitals’ mission to expand access. By addressing affordability barriers, patient financing solutions increase patient volume and improve health outcomes across communities.

Patient-Centric Approach

With 66% of Americans living paycheck to paycheck, missed payments are an unfortunate reality for many patients. Healthcare providers should carefully assess how financing partners address missed payments and patient communication. Transparent, patient-friendly approaches foster trust and align with providers’ goals to improve care access.

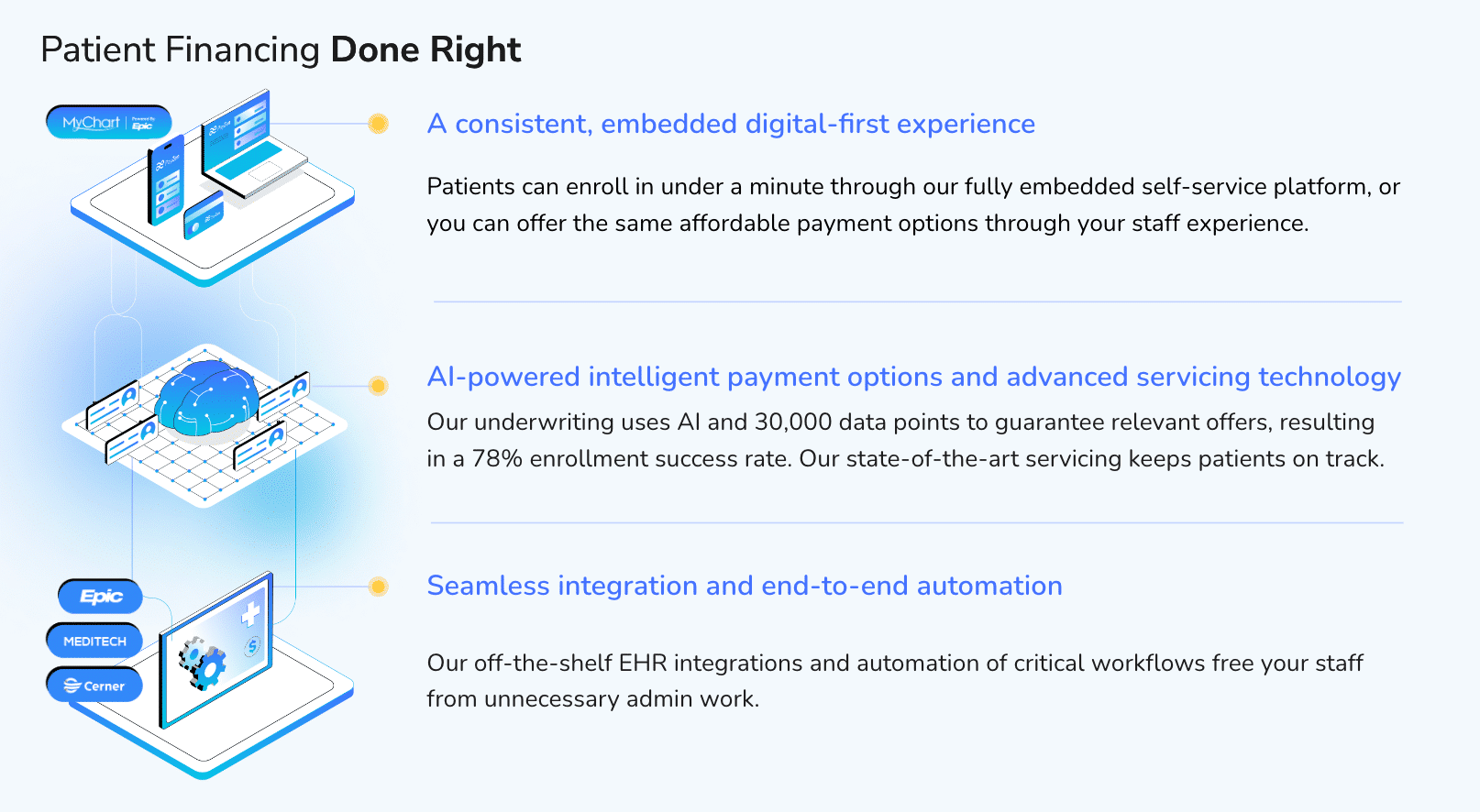

PayZen adopts a digital-first strategy, providing payment reminders and enabling patients to manage payments from their devices. It integrates seamlessly with Epic MyChart or Flywire, making the patient experience seamless with their provider.

Additionally, PayZen offers U.S.-based customer support so patients have access to personalized assistance when needed. This balanced approach helps patients stay on track while maintaining a positive relationship with their provider. Financing partners can enhance patient satisfaction and loyalty by prioritizing tailored payment plans, easy enrollment, and patient-friendly service while increasing payment collection rates.

How Patient Financing Affects Cash Flow

The right patient financing partner can significantly improve a healthcare provider’s cash flow by:

- Increasing collections on patient payments.

- Encouraging a higher volume of patients to seek care by making services more affordable.

- Accelerating cash flow by providing funds upfront upon patient loan origination or treatment.

Increased Patient Payment Collections

Tailored payment plans can significantly boost collection rates by easing financial stress for patients. 77% of patients report that extending payment periods beyond 12 months makes bills more manageable. Patient financing solutions that customize plans based on individual financial situations can help patients meet their obligations without overburdening them.

PayZen uses AI to analyze patient data and offer personalized, interest-free payment plans. By incorporating reminders and flexible payment options, providers using PayZen report a 32% increase in collections and a 30% reduction in bad debt. These outcomes demonstrate how aligning patient affordability with financial goals benefits both parties.

Studies show that 65% of patients are willing to make partial payments when presented with a cost estimate upfront. Bob Dewar, Chief Revenue Officer at Geisinger Health System as partner of PayZen, underscores the value of this proactive approach: “We have realized that we are more successful when we move collections to the front of the process. We help patients understand what their balances will be and then set up payment arrangements at that time.” This integration improves collections and strengthens trust by fostering transparency in patient financial interactions.

Increasing Patient Volume

Nearly half of Americans with private insurance postpone care due to high costs, leading to worse health outcomes, fewer patients for providers, and likely leading to more expensive care down the road as medical conditions go untreated. Flexible financing options enable patients to seek necessary care sooner, improving health outcomes and driving patient volume.

For example, PayZen’s Care Card further supports patients’ peace of mind by allowing them to charge all medical expenses upfront of their initial care estimates and pay them off in affordable, interest-free monthly payments.

Enhancing Cash Flow

Patient financing solutions that transfer financial risk to the partner, such as non-recourse models, allow providers to maintain predictable cash flow while focusing on strategic growth. Unlike recourse financing, which keeps unpaid balances on providers’ books, non-recourse financing helps reduce financial exposure.

PayZen supports providers by offering non-recourse financing, ensuring that hospitals can focus on delivering quality care without the added strain of managing unpaid balances. This model has proven effective for many partners, streamlining operations and freeing up resources.

How Patient Financing Impacts Team Workload

Rising regulatory demands and increasing patient balances have stretched administrative staff thin, making implementing a patient financing program daunting. However, choosing the right patient financing services partner can significantly reduce the burden on your team. Key considerations include the onboarding process, expected timelines, and the extent of the partner’s involvement in managing implementation. Understanding what your team will handle versus what the partner will take on is crucial, as is knowing how quickly the program’s benefits will materialize.

With PayZen, most partnerships go live within just four weeks. A dedicated Provider Success Team supports the process, ensuring a seamless transition. From coordinating staff training to integrating with systems like Epic MyChart or Flywire, PayZen takes the lead, minimizing disruptions and moving projects forward efficiently.

Freeing Staff to Focus on Strategic Work

Patient balances exceeding $7,500 have surged by 300%, creating challenges for patients and providers. Healthcare teams often spend significant time and resources chasing collections, pulling them away from more impactful tasks. The right patient financing partner alleviates this burden, allowing staff to focus on delivering quality care and driving strategic initiatives instead of managing unpaid balances.

PayZen’s fully automated platform removes the need for manual intervention at every stage—from engagement to enrollment and ongoing servicing. This approach reduces strain on providers’ revenue cycle management teams and leads to meaningful cost savings. In fact, PayZen’s partners have reported a 10% reduction in collections-related expenses, demonstrating how automation can streamline operations and free up staff to do what they do best.

The Bottom Line on Patient Financing Partnerships

Selecting the right patient financing solution is about more than improving financial performance—it’s about making healthcare more accessible and affordable for patients while minimizing the administrative burden on staff. That’s why evaluating how a financing partner will impact patient experience, team workload, and cash flow at every step of the process is essential.

PayZen’s AI-powered, end-to-end platform enhances the patient experience, removes administrative tasks, and drives measurable financial results. PayZen works seamlessly behind the scenes, from enrollment to billing and collections, to deliver tangible outcomes. For example, Marshall Medical Center experienced $1.2 million in incremental patient payments within just nine months of implementation—a testament to the platform’s effectiveness.

Unlike other patient financing companies, PayZen differentiates itself by pairing AI-driven personalization with provider-friendly terms, helping revenue cycle teams optimize cash flow while maintaining a positive patient experience.

With PayZen, healthcare teams are empowered to focus on what they do best: delivering exceptional patient care.

Take the Next Step

Learn how PayZen can help your organization enhance financial performance while delivering exceptional care. Contact us to explore healthcare patient financing options and schedule a demo.

The best patient financing solutions provide flexible, AI-powered payment plans without credit checks or hidden fees, helping patients access care while keeping costs manageable.

Strong cash flow ensures your organization can continue delivering quality care. The right partner helps by driving more patients to pay their bills, increasing overall collections, and providing upfront or accelerated payments to ensure that your A/R isn’t locked up in long-term payment plans.

A good partner integrates with your existing systems, automates payment processes, and minimizes manual tasks, freeing up staff to focus on higher value strategic initiatives.

PayZen can fully implement its solution in as little as four weeks, with dedicated Provider Success Team support to ensure a smooth launch.