What Actually Matters When Evaluating Recourse and Non-Recourse Patient Financing Solutions

If You’re Asking Which is Better, You’re Asking the Wrong Question–A Productive Framework for Evaluating Risk, Revenue and Patient Impact

As patient financial responsibility continues to rise, and with the recent passage of the “Big Beautiful Bill” expected to shrink Medicaid eligibility for millions, health systems are under increasing pressure to collect outstanding balances in ways that support both fiscal stability and a positive patient experience. Patient financing has emerged as a key strategy to address this challenge, most commonly through one of two models: recourse and non-recourse.

While these models are often defined by who holds the repayment risk, the meaningful performance differences go much deeper. Recourse financing programs may offer full payment upfront but leave providers liable if patients fail to repay. Non-recourse financing models, by contrast, shield health systems from default risk; however, some charge interest or approve only select patients, thereby limiting their overall impact.

Rather than focusing on which model is “better,” revenue leaders should evaluate how each performs across four essential dimensions. These include patient adoption, patient experience, incentive alignment, and long-term financial impact. This framework is designed to help healthcare leaders look past structure and focus on what truly drives value: sustainable collections, satisfied patients, and stronger financial outcomes.

1. Patient Adoption: Driving Utilization and Plan Performance

Strong financial performance begins with getting patients onto the right plan, but that’s only possible when approval, engagement, and enrollment work together. A financing program’s value is not defined solely by eligibility. To truly improve collections and access, health systems must evaluate each step of the adoption funnel: who qualifies, who is offered a plan, who accepts, and who completes repayment. While eligibility determines access, adoption determines results.

- Approval rate: Is the approval strategy broad enough to serve the hospital’s full patient population? Some financing partners approve only patients with high credit scores, limiting the impact to those least likely to need support. While this minimizes risk for the vendor, it leaves behind patients with greater financial need, the very group most at risk of default and bad debt. A strong financing partner should approve a large share of patients and offer terms that match their ability to repay.

- Enrollment pathways: Is enrollment directly integrated into the patient checkout process, including point-of-service workflows, EHR patient portals, and patient financial experience platforms? Or does enrollment rely on mailed packets and outbound phone calls, methods that typically result in low engagement and missed opportunities?

- Offer acceptance and plan relevance: Are patients accepting the patient financing services they’re offered, and are those offers actually sustainable? High opt-in rates depend on more than timing and presentation; they require repayment terms that reflect the patient’s actual financial situation. Offers that are poorly timed or based on generic, one-size-fits-all structures may be declined outright or lead to early dropout. Patient financing solutions should deliver personalized plans with appropriate term lengths and payment amounts that patients can reasonably afford and commit to.

- Utilization and retention: What percentage of patients who enroll actually complete their repayment plans? Are there mechanisms in place to keep patients engaged if they fall behind? Long-term adherence is just as important as initial uptake in determining the effectiveness of a financing solution.

Patient financing solutions that offer frictionless enrollment, personalized repayment terms, and timely, targeted communication consistently outperform one-size-fits-all models. High eligibility alone won’t drive results if patients don’t enroll, or if the plan they’re offered isn’t one they can realistically sustain. A strong adoption strategy supports not just better collections but better outcomes for patients and providers alike.

A Lifeline, Not Just a Loan: One Patient’s Story

I’m on a fixed income budget, facing persistent back pain, and finally found relief through a payment plan offered by PayZen through my medical provider. It has been a godsend and an answered prayer, and I now seamlessly manage medical expenses, including quarterly injections, within my financial constraints.

2. Patient Experience: The Right Terms Can Earn Patient Loyalty

How patients experience their financing plan has a direct impact on both satisfaction and repayment success. When financing is confusing for patients, punitive, or poorly serviced, it not only increases default risk but also damages trust in the health system. On the other hand, transparent terms and patient-centric support can strengthen brand reputation and turn patients into advocates.

When evaluating patient financing solutions, hospitals should consider:

- Interest and fees: Both recourse and non-recourse financing partners can charge interest or fees, sometimes retroactively or in ways that are not clearly communicated to patients. To ensure a positive experience for patients, hospitals should carefully evaluate the terms being offered and seek out partners that provide no-interest, no-fee financing. Transparent, patient-friendly pricing not only reduces financial stress but also fosters long-term trust in the health system.

- Patient protections that mirror hospital standards: All financing programs, regardless of structure, must comply with patient protection laws. For nonprofit hospitals, this includes adhering to Section 501(r), which prohibits extraordinary collection actions such as legal action, hard credit pulls, credit reporting, or wage garnishment. But compliance is only the starting point. A vendor’s practices should reflect the same standards and values the hospital upholds. Hospitals should assess how easily patients can dispute a bill once it has been transferred to a financing partner. Can patients still contest insurance discrepancies or request billing adjustments with the same ease and support as they would with the hospital directly? Just as importantly, financing arrangements should accommodate patients who qualify for full or partial financial assistance, ensuring their plans can be adjusted or resolved accordingly. The ability to resolve billing issues should remain seamless, transparent, and patient-centered, regardless of who holds the account.

- Support for hardship and plan flexibility: Patients’ financial situations can change due to job loss, illness, or unexpected expenses. Financing programs should offer realistic hardship accommodations, such as payment deferrals or plan extensions. Rigid repayment structures increase the risk of default, while flexibility often results in better long-term repayment and patient goodwill.

- Ease of use and account management: Patients should be able to manage their accounts with the same simplicity and clarity they expect from modern healthcare tools. Can they easily view balances, adjust payment methods, and understand their repayment terms? Digital self-service options, when paired with responsive, multichannel support, offer both convenience and reassurance. A great patient financing solution combines intuitive tools with accessible, empathetic customer service when questions arise.

Ultimately, financing solutions for patients directly influence the hospital’s brand and reputation. A seamless, compassionate patient experience fosters loyalty and positions the hospital as a trusted partner throughout the patient’s entire care journey.

Do Regulators Prefer Recourse or Non-Recourse Patient Financing?

Absolutely not. Regulators do not favor one financing model over another, as long as the program protects patients and complies with the law. Their focus is on how the financing is administered, which includes:

Offering affordable, interest-free payment plans

Avoiding aggressive collection tactics, such as legal action, wage garnishment, or credit reporting

Ensuring patients can still access financial assistance or have bills recalled and adjusted when appropriate

In short, what matters most to regulators is that patients are treated with fairness, dignity, and compassion, regardless of who holds the account or the structure of the financing model.

3. Incentive Alignment: Patient Financing Partners Should Share the Same Goals

The most effective patient financing solutions contribute to overall financial health by increasing collections, protecting margins, and reducing administrative overhead. To assess long-term value, hospitals should consider how a vendor fits within the existing revenue ecosystem, whether their incentives are aligned with patient repayment success, and how they draw on internal resources. The right partner will drive lift, not just volume.

- Does the program complement or compete with in-house efforts?

A well-aligned patient financing program should grow, not cannibalize, existing in-house collection efforts. External financing should focus on only patients who need longer repayment terms or more flexible options. However, some vendors enroll patients into external plans at the outset, without giving the hospital a chance to offer its own plan or the patient a chance to pay in full. This approach can compete with high-performing, in-house plans and reduce margins. Hospitals should seek partners who clearly define their role in the broader patient collection strategy and prioritize patients who genuinely require extended support. - Are the incentives truly aligned?

Financial alignment is one of the most important indicators of program success. Does the patient financing partner only succeed when the hospital and patient do, or are they paid regardless of outcomes? Some financing vendors retain a full or partial fee even when accounts are returned to the hospital. That means recoursed accounts can become the most profitable for the vendor. Hospitals should ensure that partner compensation is tied to successful repayment, not just enrollment, and that programs are structured to promote shared performance goals. - Does the financing solution reduce internal workload or add to it?

Some vendors rely heavily on internal teams to drive patient enrollment, placing a burden on front office or billing staff to explain the program and promote adoption. Others require manual reconciliation, posting, and reporting processes that consume valuable team time. Hospitals should evaluate whether patient financing companies offer seamless integration and automation, or whether the model shifts more work back onto internal teams. A well-aligned program should reduce operational complexity, not increase it.

4. Financial Impact: The Headline Rate Isn’t the Whole Story

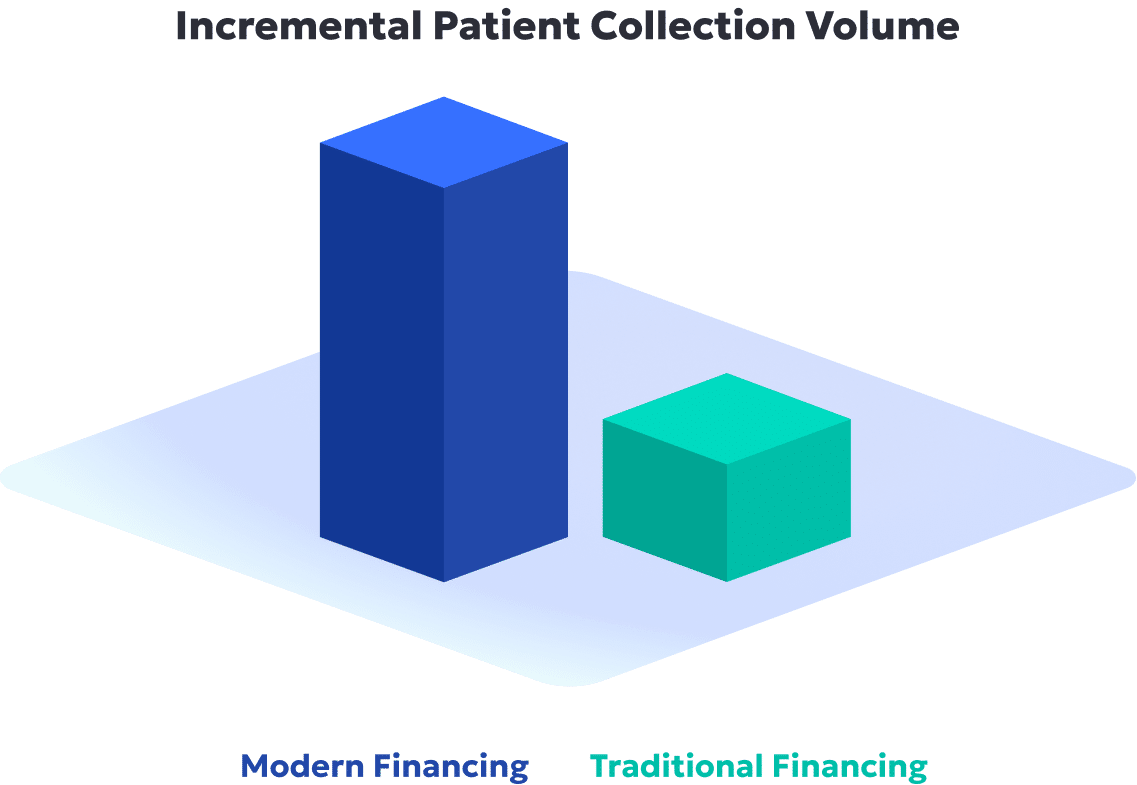

When evaluating patient financing models, the most important question isn’t “What’s the rate?”—it’s “How much new patient payment volume does this program generate?” Whether the financing structure is recourse or non-recourse, incremental lift should be the primary benchmark. Large health systems may even negotiate for a portion of that lift to be guaranteed, ensuring the program delivers measurable value over time.

Recourse Patient Financing Models

Recourse arrangements often promote low headline rates—typically 10 to 20 percent—but these figures can be misleading. When recourse is applied, effective costs often rise to 35 to 40 percent once write-offs, administrative overhead, and servicing costs are factored in.

Hospitals should ask:

- What is the actual cost once a program is fully mature? What percentage of accounts are expected to recourse, and are financing fees still charged on those returned balances?

- What is the operational burden? Are internal teams responsible for enrolling patients, managing reconciliation, and re-engaging accounts that default months later?

- How predictable is the revenue? Do clawbacks introduce cash flow volatility that forces capital to be held in reserve?

These downstream impacts can erode margin, strain revenue cycle staff, and complicate financial planning. During periods of economic instability, the risks become even more pronounced.

Non-Recourse Patient Financing Models

Non-recourse structures often offer flat, all-in pricing and guaranteed payments, making financial modeling more straightforward. But cost predictability alone doesn’t ensure program value. Hospitals should assess:

- Patient Approval: Does the partner approve a wide range of patients, or only those with high credit scores?

- Term availability: Are extended, affordable terms offered to most patients, or is flexibility limited?

- Patient pricing: Are patients charged interest or hidden fees?

- Servicing impact: Does the partner handle the full account lifecycle—from enrollment through repayment—reducing internal lift?

A robust non-recourse financing program will facilitate broad patient access, mitigate revenue volatility, and reduce administrative burden. However, some models limit approvals or restrict terms, ultimately failing to deliver meaningful lift. The key question becomes: Is the non-recourse solution expanding total patient collections, especially among those who would otherwise default?

If the answer is yes, a higher cost may be well worth it.

Conclusion: It’s Not Just About Recourse vs. Non-Recourse Financing—It’s About Performance

Recourse and non-recourse financing models each offer potential paths to reduce bad debt and increase patient collections. But the most important question isn’t which model to choose—it’s whether the solution delivers real, measurable outcomes.

The most effective patient financing solutions:

- Drive meaningful lift in patient collections, especially from those at risk of default

- Expand patient access by approving a broad patient population, not just those with the highest credit scores

- Offer transparent, interest-free financing for patients that builds trust and long-term loyalty

- Align operationally with in-house billing efforts and reduce internal workload

- Deliver stable, predictable cash flow to support financial planning

Regardless of structure, when a financing partner checks all the boxes and brings modern technology, automation, and innovation to the table, the results speak for themselves. A modern patient financing solution can maximize patient collections, delivering a 2–3 times higher payment lift on average, while also enhancing patient access, experience, and trust.

That is where PayZen comes in. As an AI-powered patient financing solution, PayZen is on a mission to help solve healthcare affordability, combining patient-centric financing with provider-aligned economics. PayZen’s personalized payment plans meet patients where they are financially, without interest, fees, or administrative complexity—delivering happier patients and more revenue for providers.

How PayZen Stacks Up

| Evaluation Criteria | What to Look For | How PayZen Delivers |

|---|---|---|

| Collections Lift | Drives meaningful lift, especially among patients at risk of default | Through its technology, PayZen drives the most meaningful collections lift on the market by converting more accounts that would otherwise go to bad debt |

| Patient Access | Approves a broad swath of patients, not just those with high credit scores | Uses AI to underwrite based on true ability to pay, enabling approvals for patients often excluded by traditional financing models |

| Transparency & Trust | Offers interest-free, fee-free plans to promote trust and affordability | Always 0% interest, no hidden fees, no aggressive collection tactics. Patient satisfaction continues to rise, with a Net Promoter Score of 71 (50% higher than the industry average) |

| Operational Alignment | Integrates with in-house billing strategies and reduces internal burden | Embedded into EHRs and patient portals, with automated workflows and full lifecycle servicing. Supports the growth and utilization of in-house plans – no cannibalization |

| Cash Flow Stability | Offers predictable payments to support financial planning | Offers both recourse and non-recourse financing for patients. With non-recourse, PayZen delivers guaranteed payments and eliminates clawbacks. With recourse, terms are transparent, and lift is guaranteed to offset financial risk |

Want to explore a smarter approach to patient financing?

Request a demo to see how PayZen delivers AI-powered financing solutions that help patients and the bottom line.