The steady shift of financial responsibility from health insurance plans to patients has put affordable healthcare out of reach for many. Facing rising deductibles, more than half of Americans can’t cover an unexpected medical expense of $1,000. On the other side of this faltering system, healthcare providers already battered by the pandemic are facing declining revenue from medical billing, rising costs, and a significant labor shortage.

For a challenge as complicated as America’s healthcare affordability crisis, it can be daunting to envision, much less implement, meaningful solutions for affordable healthcare. Where do we even begin?

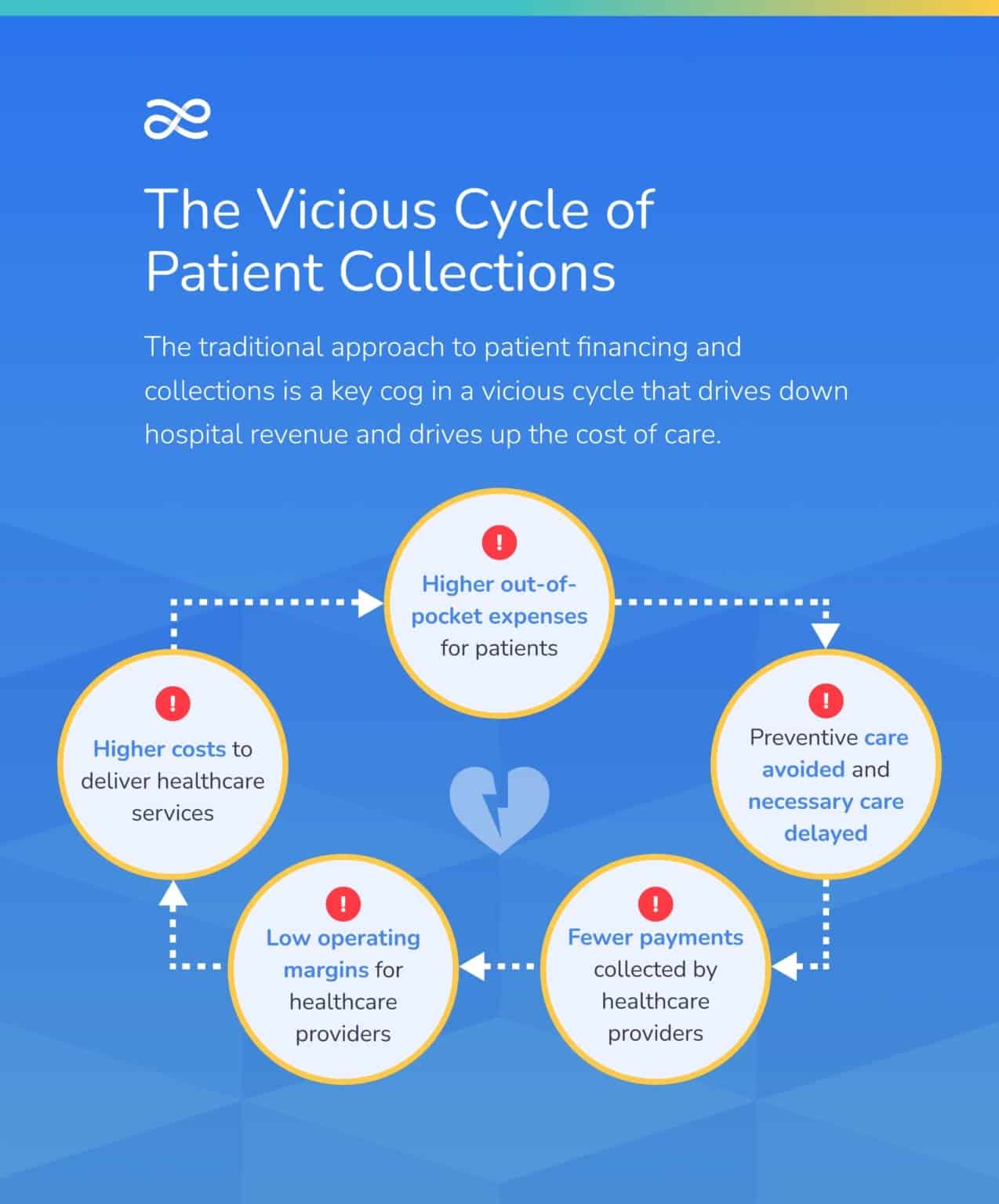

At PayZen, we see the traditional approach to patient financing options and collections as a key cog in a vicious cycle that drives down hospital revenue and drives up the cost of care. We believe that leveraging new technology to offer healthcare affordability solutions is a critical step in not only breaking this vicious cycle, but transforming it into a virtuous one.

The vicious cycle of patient collections in healthcare

For patients, getting stuck with an unexpected out-of-pocket medical bill can be traumatic—mentally, emotionally, and financially. Unlike with other commodities and services, healthcare consumers are often unaware of impending costs prior to care. Recent efforts to improve price transparency have been far from perfect, and even when cost of care is known, patients often lack the financial literacy to understand their insurance coverage and payment responsibility. The absence of affordable patient financing options means patients are often faced with large, lump payments they can’t afford.

This assumes the patient receives care to begin with.

Caught between the rising cost of everyday expenses like gas, food, and utility bills on one side and unpredictable, expensive medical bills on the other, many people choose to postpone or forgo necessary treatment.

Meanwhile, healthcare providers have relied on traditional medical billing solutions, like early out vendors and debt collection call centers, to recoup patient responsibility. This approach means patients that might otherwise pay their medical bills if offered the chance to do so over time are instead sent into a debilitating and ineffective collections system. Even if offering in-house payment plans, many providers carry significant patient receivables on their books and typically expend valuable staff resources trying to collect those receivables $50 at a time.

Whether a patient avoids care on the front end or is unable to pay for it on the back end, the end result is less income for healthcare providers already struggling with razor thin operating margins. The inflation of supply costs coupled with the skyrocketing cost of labor amid a critical staffing shortage has put immense pressure on hospital finances: over 33 percent of hospitals are currently operating on negative margins.

Healthcare providers can’t operate on a loss indefinitely; you have to at least break even. Some of the cost increase must be passed on through the pre-negotiated rate with payers. Depending on coinsurance and deductibles, some of this will, by definition, trickle down and push more patients beyond the out-of-pocket maxes on their insurance plans, making healthcare even less affordable.

Here, we’ve come full circle. The lack of affordable, transparent bill payment options (including patient financing) means fewer patients receive and pay for care, which tightens hospital margins and further drives up the cost of care.

Creating a virtuous cycle with affordable patient financing options

Most of the macroeconomic factors driving the vicious cycle of patient collections in healthcare—inflation, supply cost hikes, and staffing shortages—are beyond the control of individual providers and networks. What you can control are patient financing options.

By investing in solutions for affordable healthcare at the point of payment, we can turn the vicious cycle on its head: more manageable payments mean more affordable care for patients and improved collections for hospitals. Here are three ways to invest in healthcare affordability for better patient collections:

1. Invest in predictive modeling. AI and machine learning can be used to mine patient data and evaluate an individual’s ability to pay. Before a patient even receives their bill, propensity to pay modeling gauges whether they’ll struggle to afford payment. By proactively identifying patients at risk of medical debt, we can preemptively support them by personalizing their patient financing options.

2. Invest in digital payment tools. The COVID-19 crisis dramatically accelerated the rate of digital payment use. Data collected by McKinsey & Company showed that the first eight weeks of the pandemic accelerated digital adoption by five years.

Today’s patients want more out of the medical billing and payment process, which requires a digital-first approach to the patient financial experience. For example, PayZen has strategically partnered and integrated with Flywire, a global payments enablement and software company. A digital payments platform like Flywire, integrated with PayZen in order to present each patient with the right financial option based on their individual circumstances and budget, is key to delivering the financial experience patients crave.

New technology offers patients automated engagement to inform them of affordable patient financing options, quick and easy sign up from any device, and online servicing to manage payment plans after enrollment (such as adjusting payment date or changing payment methods). Committing to these digital tools increases convenience, improves healthcare affordability, and reduces burden on staff to create a better patient experience.

3. Invest in patient financing solutions optimized for affordability. Given the power of predictive modeling, we can’t treat financing with one-size-fits-all, cookie cutter plans. Platforms like PayZen offer personalized payment financing options tailored to each patient’s unique financial circumstances, all with zero interest or fees. The ability to disperse out-of-pocket payments over a longer period of time can make all the difference to a cash-strapped family struggling to balance a budget.

The ROI of investing in healthcare affordability solutions

Before making these investments, you might be wondering, “is it worth it?” Besides the obvious need to address challenges exposed by today’s “vicious cycle” of patient collections, our experience has shown that investments in healthcare affordability solutions can deliver significant returns. Providers using PayZen’s AI-driven medical billing solution to deliver personalized patient financing options have lifted collections by up to 50 percent over existing baseline.

This infusion of cash leads to healthier margins and less cost passed on to patients. With more robust cash flow, you can invest in better care, facilities, services, and access for your patients. By investing in affordable healthcare solutions for every patient, we create a feedback loop that drives sustainable, positive change to the patient revenue cycle.